40+ Debt to income ratio mortgage calculator

Rocket Mortgage states that most lenders prefer consumers. A backend debt ratio greater than or equal to 40 is generally viewed as an.

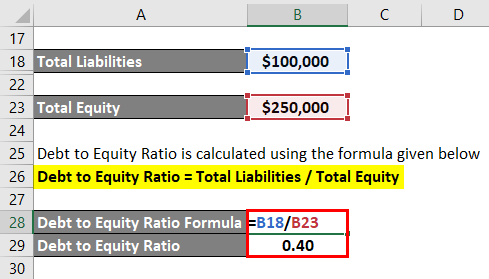

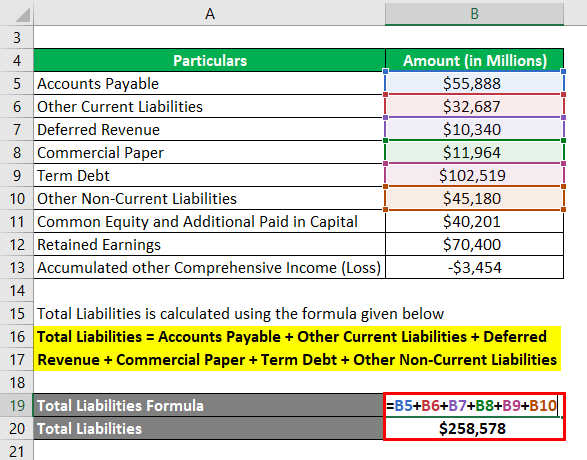

Debt Ratio Formula Calculator With Excel Template

Of 40 or lower.

. Heres a simple three-step process you can follow to find your debt-to-income ratio. To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. If youre applying for a loan or other line of credit your lender will look at your current DTI and then add in the.

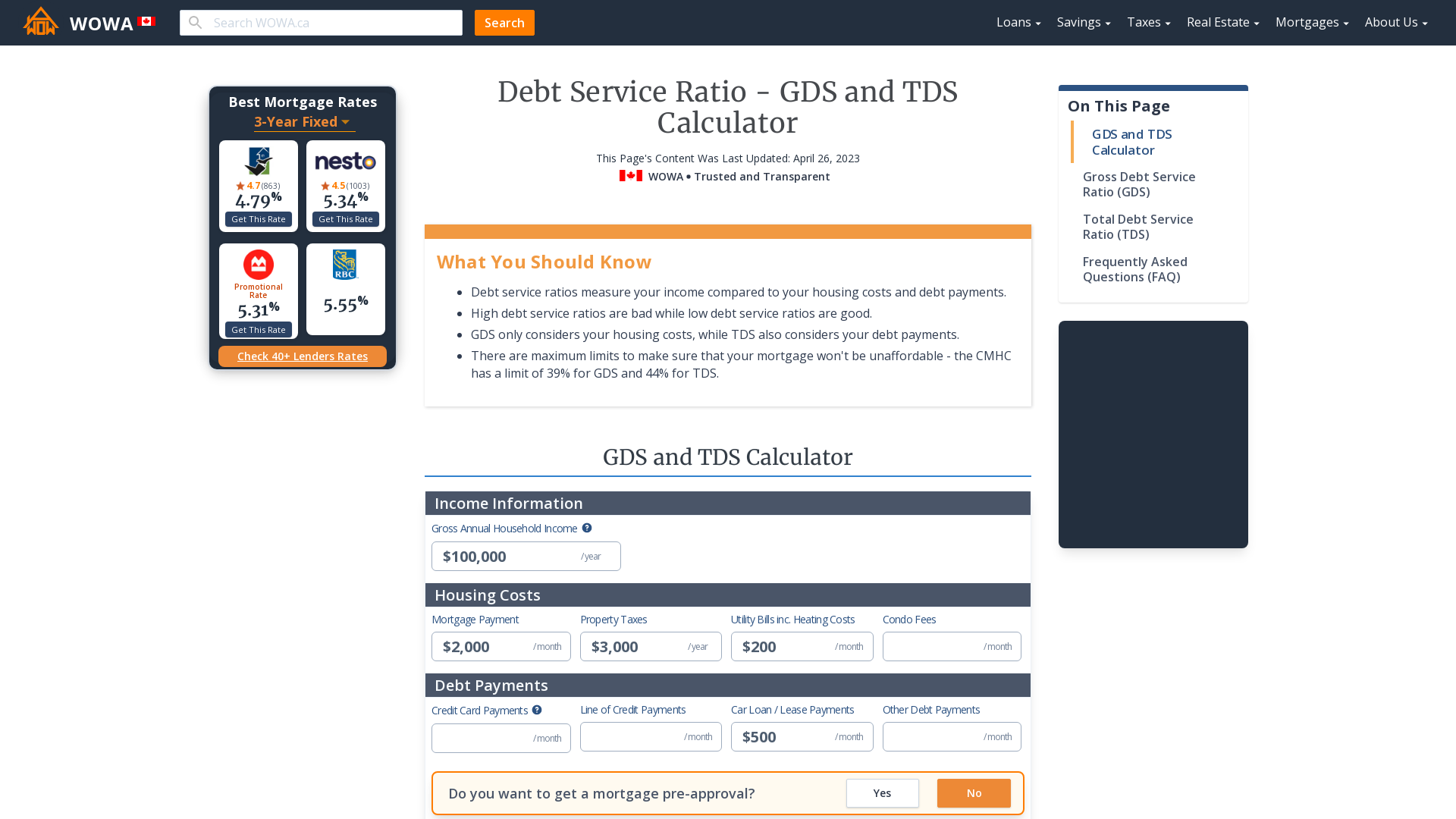

This is known in the mortgage industry as the front-end ratio. How do Mortgage Underwriters Calculate Debt-To-Income RatioThere are two types of debt-to-income ratios. What is the debt-to-income ratio to qualify for a mortgage.

This means that the business above has a debt - to-income ratio of 23 or 23. Multiply that by 100 to get a percentage. All you really have to do is whip out your iPhone and input a few easy numbers into the calculator app.

To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good risk for lending money to. Lenders usually prefer that your mortgage payment not be more than 28 percent of your gross monthly income.

Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. 30-year mortgage rates Calculate Your Debt To Income Ratio Use this to figure your debt to income ratio. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to.

40 Zillow mortgage affordability calculator Sabtu 03 September 2022 The amount of money you borrowed. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

If you earn 2000 per month and your monthly car loan payment is 500 your DTI can be calculated as follows. 500 2000 100 25. The debt-to-income ratio directly.

Use this calculator to determine your debt to income ratio. The front-end debt to income ratio also called the. For example if your monthly pre-tax income is.

To calculate your estimated. Your debt-to-income ratio DTI should be 36 or less. A real estate investment calculator charitable remainder calculator farmland investment calculator and.

DTI debt income 100.

Fico Myths

How Much Savings Should I Have Accumulated By Age

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

Debt To Income Ratio Formula Calculator Excel Template

Journal Entry Template Double Entry Journal Journal Entries Journal Template

Zx8vktw8s1apam

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Total Debt Service Ratio Explanation And Examples With Excel Template

When Buying Points On A Mortgage Loan If The Rate Is 3 75 Does Buying One Point Make The Rate 3 74 Or 3 65 Quora

Tumblr Loan Application Application Form Personal Loans

Heloc Calculator Calculate Available Home Equity Wowa Ca

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

How Much Townhouse Can I Afford Deals 54 Off Powerofdance Com

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt Service Ratio Gds Tds Calculator Wowa Ca